nebraska vehicle tax calculator

The county the vehicle is registered in. This means that you save the sales taxes you.

How do I increase or decrease the registered weight for my vehicle when renewing online.

. Search for cheap gas prices in Nebraska Nebraska. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Cost factors included in your monthly payment.

Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc. Use the car payments calculator to help determine your monthly car payments so you can find the right car and stay within budget. How much do you think your household spends on vehicle fuel in an average month.

Gasoline and Diesel Fuel Update Energy Information Administration. You can estimate your taxes using Nebraskas tax estimator. Instead of looking at rates per assessed value it can be useful to look at taxes paid as a percentage of home value.

These fees are separate from. Nebraska charges a motor vehicle tax and a motor vehicle fee that is based upon the value and weight of the vehicle being registered so the charges will vary. A tax credit is available for the purchase of a new qualified PEV that draws propulsion using a traction battery that has at least five kilowatt-hours kWh of capacity uses an external source of energy to recharge the battery has a gross vehicle weight rating of up to 14000 pounds and meets specified emission standards.

The state of Louisiana does not include recreational vehicles in the IFTA tax unless they are used in conjunction with any business endeavor. This is called an effective tax rate which is a countys median annual property tax paid as a percentage of its median home value. Monthly Payment Vehicle Budget.

What is in a Barrel of Crude. Having three or more axles regardless of weight. Lets calculate a monthly budget that works for you.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Fuel Tax State Map. In Iowa the taxable price of your new vehicle will be considered to be 5000 as the value of your trade-in is not subject to sales tax.

Estimated tax title and fees are 1000 Monthly payment is 405 Term Length is 72 months and APR is 8. Ohio Documentation Fees. The type of license plates requested.

Sales tax may vary by county. Evidence of compliance with the IRS heavy vehicle use tax requirements must be presented. Whether or not you have a trade-in.

Retail Gasoline Prices Regular Grade Energy Information Administration. Find local Nebraska gas prices gas stations with the best fuel. But contributes to the total cost of purchasing a vehicle.

Evidence or application for the continuing qualification for tax-exempt status must be presented. Your household income location filing status and number of personal exemptions. For example you could trade-in your old car and receive a 5000 credit against the price of a 10000 new vehicle making your out-of-pocket cost only 5000.

Average DMV fees in Ohio on a new-car purchase add up to 48 1 which includes the title registration and plate fees shown above. Less than 50 50 - 150 150 - 250 250 - 350. Or used in combination when the weight of such combination exceeds 26000 pounds or 11797 kilograms gross vehicle or registered gross vehicle weight.

Find Your States Vehicle Tax Tag Fees When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. Registration fees for all passenger and leased vehicles are. Shop Cars By Price.

National and Regional Fuel Prices. Commercial and farm-plated vehicles registered for more than 27 tons. New car sales tax OR used car sales tax.

The state in which you live. The table below shows the average effective tax rate for every county in Missouri.

Renew Vehicle Registration License Plates Douglas County

Dmv Fees By State Usa Manual Car Registration Calculator

Car Depreciation How Much It Costs You Carfax

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

What S The Car Sales Tax In Each State Find The Best Car Price

Dmv Fees By State Usa Manual Car Registration Calculator

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

It Is Said That Everyone Can Get A Bad Credit Loan However This Is Not Always True There Are Some People That Can Neve Payday Loans Personal Loans Cash Loans

13 Cops Explain How To Get Out Of A Speeding Ticket Cheesy Jokes Halloween Quotes Funny Jokes For Kids

Which U S States Charge Property Taxes For Cars Mansion Global

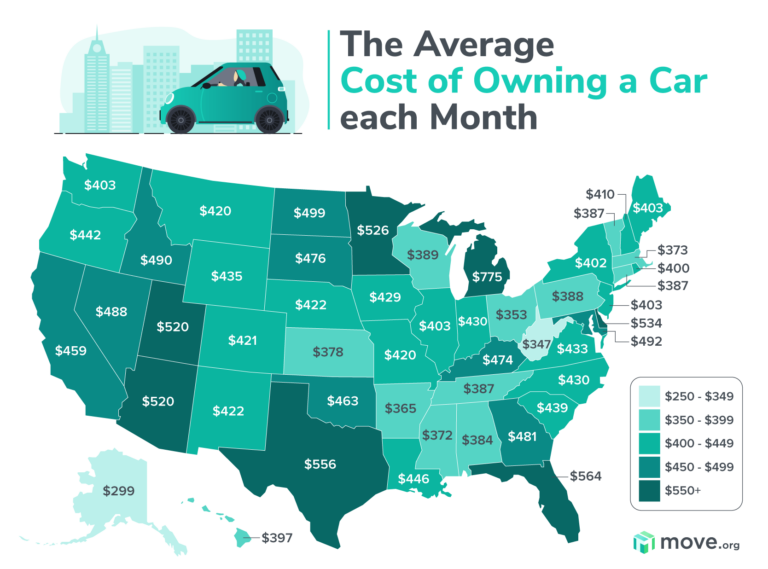

The Average Cost Of Owning A Car In The Us Move Org

Taxes And Spending In Nebraska

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

Taxes And Spending In Nebraska

Dmv Fees By State Usa Manual Car Registration Calculator

Car Sales Tax In Nebraska Getjerry Com

Car Tax Disc Changes Five Facts You Never Knew About Your Almost Obsolete Tax Disc The Independent The Independent

Ifta Is Offering Something New To Its Subscribers Wanna Know What Tax Return Online Classes Tax